Federal Agriculture Minister Lawrence MacAulay has announced an early list of Livestock Tax Deferral regions for 2024.

This year, the Government has streamlined the process to identify regions earlier in the growing season, and has included a new buffer zone adjacent to the designated regions to capture impacted producers that may be on the edge of affected areas.

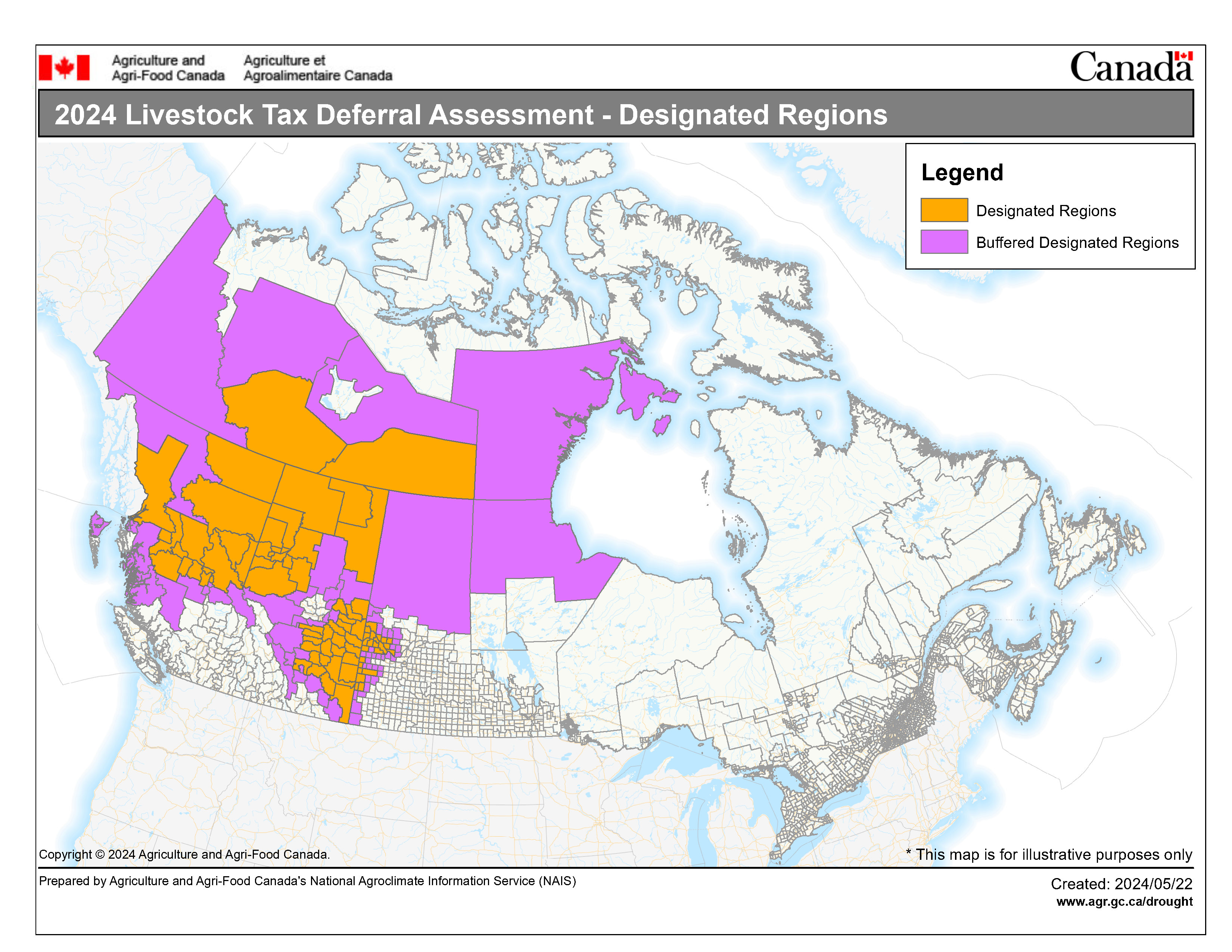

This year, the majority of Alberta falls into either the designated or buffered designated regions.

Designated regions in Saskatchewan are located on the western side of the province, with the buffered regions extending south and covering all of northern Saskatchewan, that buffered region also extends into Northern Manitoba.

The Livestock Tax Deferral provision allows livestock producers in certain areas who are forced to sell all or part of their breeding herd due to drought, flooding, or excess moisture to defer a portion of their income from sales until the following tax year.

The concept is that it will help reduce the tax burden of the original sale and partially offset the cost of rebuilding their breeding herd.

MacAulay says that by announcing the Livestock Tax Deferral regions earlier in the year and applying buffer zones to increase flexibility, we're helping farmers make informed decisions and build up their resilience.

His department will continue to monitor weather, climate, and production data from across Canada and will update the list, adding regions as needed when they meet the criteria.

- Subsequent regions will be added to the list when they meet the eligibility criteria of forage shortfalls of 50% or more caused by drought or excess moisture.

- To defer income under the Livestock Tax Deferral provision, the breeding herd must have been reduced by at least 15%.

- In the case of consecutive years of drought or excess moisture and flood conditions, producers may defer sales income to the first year in which the region is no longer prescribed.

The list of designated areas can be found here.